Planning Next Generation Housing

Next Generation Housing provides for a growing workforce, improved quality of life and stronger overall economy.

Housing and workforce are the first factors employers consider when investing. Housing and schools are typically the first factors family’s consider when relocating. If the housing stock in a rural community declines businesses and schools suffer directly. Without continued investment diminishing housing stock will eventually erode progress across all economic sectors.

WEGA is working to help Developers provide new solutions to meet today’s demands. We are working with community leaders, employers, bankers, realtors, housing developers, grant organizations and supporting organizations to find affordable, quality solutions. WEGA seeks to accelerate housing development, lower the cost of entry and achieve higher quality design.

Today’s rural communities are unique with unique cultural requirements. They require new, well-considered solutions.

Planning for Growth

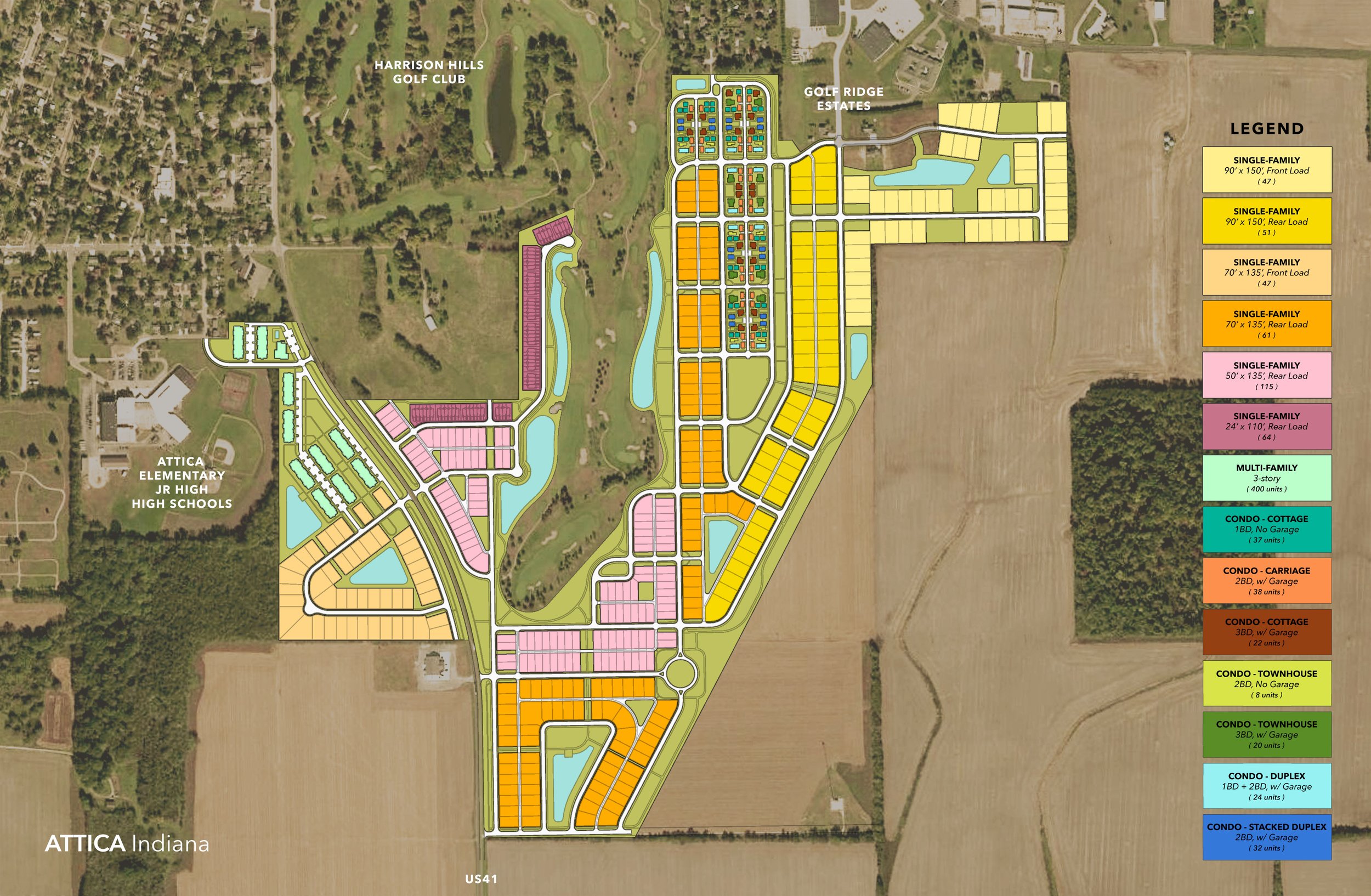

WEGA works with residential developers and top masterplanning professionals to produce uniquely rural solutions to house the next generation workforce. Initiatives include prioritizing connections to nature and social gathering; providing spacious living and efficient access; and supporting localized farming and engaging amenities. Rural environments and cultures are unique and should be uniquely served.

Planning for Quality

WEGA seeks unique housing solutions that compliment rural communities. To assist with this ambition, WEGA strikes partnerships with design professionals that have a track record of producing quality, thoughtful solutions.

Provide for Community

Whether its an inherent desire to help others with self-reliance or just the joy of knowing your neighbors, rural communities prize social interaction and time spent together. Successful solutions plan for community encounters.

Incorporate Nature

Nature isn’t far away in rural environments. Weather, seasons and the pattern of the natural life are woven into the everyday experience. This connection is important and should be part of any housing solution.

Provide for Openness

Unlike urban areas, rural communities are not short on land or access to open land. Residents are used to having space and easy mobility. This is an important aspect to address when meeting the community’s cultural preferences.

Value Relaxed, Simple Beauty

Building in a rural environment typically means building in nature. Architectural styles may achieve personal preferences but simple always works. It is often more affordable, lacks pretense and connects seamlessly with the environment.

Planning for Variety

The lifestyles of the next generation workforce is varied, so the housing solutions must be too. Updated solutions over conventional formulas can provide a competitive advantage.

Patio Condos

Patio Condos are typically small single story units attached to other units in a single building. Owners own within the exterior walls. A homeowner association owns and maintains the rest.

Townhouse Units

Townhouse units are fully owned units attached side by side with individual entrances, front and back yards. Owners own the building unit and the land associated.

Rural Multi-Family

Rural Multi-family rentals are typically side by side or stacked units with common yards, amenities and garages. Units are 2 and 3-bedroom units with separate entrances.

Urban Multi-Family

Urban multi-family rentals are multiple units in a single building or buildings with a common entrance, walls and amenities.

Single-Family Starter

Single-Family starter homes are the most cost effective and efficient of its category. They are designed for singles and small families.

Single-Family Spec

Single-Family spec homes are Developer designed and prebuilt for sale. Though they can also be starter solutions they are typically mid-market solutions.

Single-Family Custom

Duplex rentals are typically side by side units with separate/private yards and garages.

In-Town Rentals

In-Town rentals can take many forms however, they are typically 2-10 units with separate entrances in a single building.

Planning for Updated Designs

Needs and expectations change. Any new development solutions should be attentive to current design choices and features to meet expectations.

Simple forms

Current trends lean toward simplicity and classic building shapes. This is due to both cost efficiency and style choice.

Dual-purpose Rooms

These spaces typically include layouts to accommodate multiple uses and easy circulation. They also include taller ceilings, vaulted features, ample natural light and hardwood floors.

Connection to Nature

Solutions emphasize large windows, natural light, garden views, abundant landscaping, inside and outside living.

Bonus Rooms

These are versatile rooms that can be used for a home study, library or office, home school classroom, gym, wine storage, guest quarters, etc.

Outdoor Living

Solutions include outdoor living rooms, kitchens and dining areas, jetted tubs, vegetable gardens, fire pits, lawn games, etc.

Unique Features

These features include built-in storage, a kitchen pantry, walk-in laundry, a long or double wide kitchen island, breakfast nook, coffee bar, rain shower heads, double bath sinks, surround sound, etc.

Natural Finishes

Customers currently prioritize natural finishes and colors, hardwood flooring, healthy indoor construction materials and finishes.

Energy + Smart Features

These features include high efficiency HVAC systems, smart thermostats, networked appliances, lighting and sound management systems, cloud managed security systems, etc.

Items to skip

Out of fashion items include vinyl siding, solid vinyl windows and doors, molded interior doors, vinyl shutters, most faux finishes, small sash windows, fake historic gridded lites, and dated color schemes.

Incentive Programs

WEGA works with various agencies, commissions and programs to incentivize new housing development. Each project is unique so we primarily serve as strategist and development accelerator. We help Developers find effective partnerships and solutions. We can also help prepare green field sites for development. Below are some of the programs we use to help communities incentivize Developers and developments.

Indiana Residential TIF - Administered by the applicable taxing jurisdiction.

Indiana’s residential tax increment finance (TIF) structure allows counties, cities and towns to pay for infrastructure intended to serve new residences. The taxing jurisdiction establishes a TIF district, and then issues a bond to finance the infrastructure such as roads, water and sewer systems, built amenities etc. Jurisdictions continue to tax the existing assessed value of property in the district, but revenue generated by the added assessed value from the development is diverted to repay the bond. Once the bond is repaid, the TIF district expires and the added assessed value is available for general taxation.

READI Housing Program - Administered by Greater Lafayette Region

Early 2021, the State of Indiana created the Regional Economic Acceleration & Development Initiative (READI) allocating federal ARPA funds for economic development state-wide. The Greater Lafayette Region which includes Benton, White, Carroll, Fountain, Warren and Tippecanoe counties applied competitively to achieve a $30 million award. As a result the five rural counties received $1,498,920 to assist with new housing utility installations. These funds were available for “ready to execute” projects. Fountain County awarded funding to housing developments in Attica and Covington. The region is currently participating in a regional housing study provided with READI funds.

Indiana Residential Housing Infrastructure Assistance Program - Administered by the Indiana Finance Authority

This program allows local governments to obtain a low interest loan to pay for "public infrastructure," such as water, sanitary sewers, storm sewers, lift stations, streets, sidewalks, traffic signals, street lights and utility distribution lines. The loan cannot be used for debt repayment, maintenance and repair projects, upgrading utility poles, or consulting and engineering fees for studies, reports, designs, or analyses. The state requires 70% of the money in the fund to be used for housing infrastructure in municipalities with populations less than 50,000. They County may adopt an ordinance to designate an economic development target area and set economic development priorities.

Indiana State 9% Tax Credit Program - Administered by IHCDA

Indiana’s 9% Tax Credit Program plays an important role in promoting the production of affordable rental housing. This program can generate nearly 70% of a development’s equity. This allows Developers to produce projects in areas that are not traditionally financially competitive.

This program works well in communities with limited rental housing and high value, for-sale homes. Developers establish rental rates based on the County’s AMI and set a rental tier structure in the initial application. The program requires a variety of rates including market rate. All lower wage earners can pay a percentage based on their income however they must be fully employed and qualify each month. The program application process is competitive and requires long term ownership and management. Once awarded the project remains in this structure for the first 15 years and then it can become fully market rate.

This program is NOT a federal welfare program. It is a tax incentive to encourage Developers to invest.

Indiana State 4% Tax Credit / Affordable Workforce Housing Credit - Administered by IHCDA

The 4% tax credit program can generate nearly 30% of a development’s equity. Developers use 4% tax credits primarily for those projects seeking financing through tax-exempt private activity bonds. This application is not competitive. It is only restricted by the state’s yearly allocation.

First Place - Administered by IHCDA

First Place is a down payment assistance program that offers borrowers 6% of their overall purchase price no a 30-year fixed interest rate FHA loan. This program is reserved for first-time homebuyers, unless the property is located in one of Indiana’s target areas or the buyer is a veteran. If your debt-to-income ratio is under 45%, you’ll need a minimum credit score of 640. If your ratio is in the 45% to 50% range, you’ll need a credit score of at least 680.

Next Home - Administered by IHCDA

Next Home is a down payment assistance program that offers borrowers 3.5% on an FHA 30-year fixed-rate loan. You don’t need to be a first-time buyer to qualify. The credit score requirements are the same as with the First Place program. Unlike First Place, this program can be used in conjunction with the Mortgage Credit Certificate (MCC).

Mortgage Credit Certificate - Administered by IHCDA

A Mortgage Credit Certificate can help you reduce the amount you owe in federal income tax each year; and in doing so, can increase your qualifying income. This program is reserved for first-time homebuyers, with the exception of veterans and individuals buying property in targeted areas. The MCC can be used with the Next Home program and with government-backed loans, ie. Ginnie, Fannie or Freddie.